U.S. shares edged modestly upper on Wednesday as Wall Boulevard attempted to construct on a year-end rally, with a contemporary document in sight for the S&P 500 index.

On Tuesday, the Dow booked a 5th immediately document shut, whilst the S&P 500 closed at its very best stage since Jan. 4, 2022, and the Nasdaq prolonged its successful streak to a 9th day.

What’s using markets

U.S. shares had been edging upper on Wednesday with the S&P 500 lower than 1% shy of the all time remaining top of 4796.56 it recorded in January 2022, whilst the Dow industrials and Nasdaq had been suffering to increase their 9 consecutive day by day positive aspects.

The huge-cap benchmark S&P 500 has jumped 24.3% this yr, partially powered by means of hopes that the U.S. economic system has now not been too badly broken by means of the Federal Reserve’s ratcheting up of rates of interest to chill inflation.

The newest leg of the rally displays hopes that with inflation back off to a few.1%, the central financial institution will start briefly trimming borrowing prices subsequent yr. No longer even a concerted effort by means of Fed officers to counter the marketplace’s rate-cut optimism has damped the ardor of buyers.

See: Why the 60-40 portfolio is poised to make a comeback in 2024

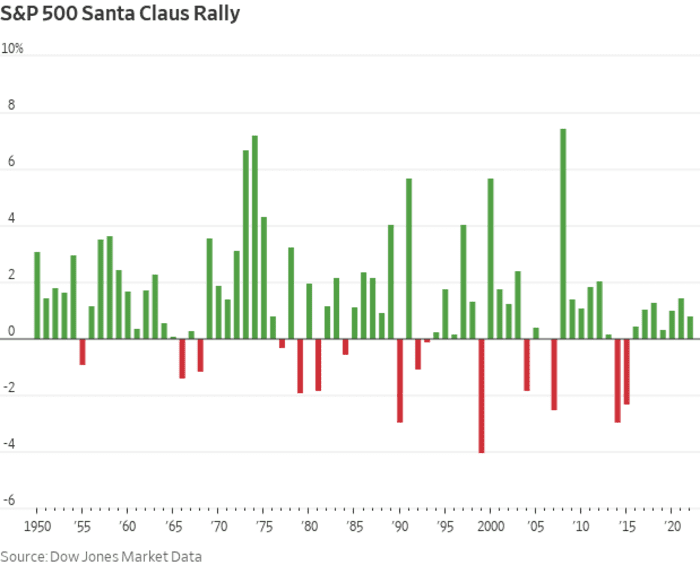

The present bullishness is in all probability additionally reflective of seasonal developments, with optimism a couple of festive jump underpinning shares. The “Santa Claus Rally” duration stretches from the closing 5 buying and selling days of the yr to the primary two buying and selling days of the brand new yr, in keeping with theInventory Dealer’s Almanac.

Since 1950, the S&P 500 has averaged a acquire of one.32% and closed upper 78.1% of the time over that duration, in keeping with Dow Jones Marketplace Knowledge.

With shares on a tear because the finish of October amid what’s been described as an “the whole lot rally,” “valuations are as soon as once more somewhat stretched so the marketplace is taking somewhat of a breather” on Wednesday, mentioned Eric Sterner, leader funding officer at Apollon Wealth Control in Mount Delightful, S.C., which manages about $7 billion in property.

“The tailwinds, so that you can talk, come with the Fed’s extra dovish pivot that stuck the marketplace off guard,” Sterner mentioned by means of telephone on Wednesday. “And at the different facet, one of the crucial headwinds are that the markets had been on an out of this world run and feature driven valuations very top traditionally talking. We will debate whether or not there’s going to be a troublesome or comfortable touchdown, however we will be able to all agree that the economic system is slowing down and user spending is predicted to relatively lower in coming quarters.”

In U.S. financial knowledge, existing-home gross sales rose 0.8% in November to a few.82 million, the Nationwide Affiliation of Realtors mentioned on Wednesday. Gross sales of in the past owned properties impulsively inched up closing month, snapping a five-month droop aseasing loan chargesinspired some U.S. domestic patrons.

In the meantime, the U.S. user self assurance index rose to a five-month top of 110 in December, up from a downwardly revised 101 within the earlier month, the Convention Boardmentioned Wednesday.

“The patron is feeling lovely neatly as charges transfer decrease, employers upload to their payroll, and source of revenue expectancies give a boost to,” mentioned Jeffrey Roach, leader economistat LPL Monetary. “Thus far, buyers have a inexperienced mild as they merge into the brand new yr.”

That mentioned, buyers will proceed looking for steering fromextra financial knowledge due later this week that can supply larger readability at the Fed’s interest-rate trail in 2024. A revision of the third-quarter GDP print is predicted Thursday morning, adopted by means of Friday’s non-public intake expenditures (PCE) inflation document — the Fed’s most well-liked inflation gauge.

Corporations in focal point

- Stocks of Tesla Inc.

TSLA,

-0.38%

held quite secure amid studies that the automaker has made up our minds to chop out merit-based grants from employee-compensation applications. - Stocks of Alphabet Inc.

GOOGL,

+3.02%

jumped 2.8% on Wednesday following a Reuters document that mentioned its Google unit plans to reorganize a big a part of its advertising-sales unit. - Stocks of FedEx Corp.

FDX,

-10.89%

slumped 11.1% after the package-delivery massive trimmed its full-year gross sales forecast amid persisted issues about subdued transport call for throughout the height vacation season. - Stocks of Normal Generators Inc.

GIS,

-2.38%

had been off 2.6% after the consumer-foods corporate overlooked fiscal second-quarter income expectancies and reduced its full-year outlook as shoppers proceed “stronger-than-expected value-seeking behaviors.”

— Jamie Chisholm contributed.

FAQs

The stock market during Biden's tenure trended higher, but with significant volatility. The benchmark S&P 500 generated impressive returns of 28.7% in 2021 and 26.29% in 2023. Sandwiched in between was a bear market, as the S&P 500, at its low point, dropped 25% in 2022.

What is the US stock market doing today? ›

The Dow Jones Industrial Average fell 234.21 points, or 0.60%, to 38,763.45. The S&P 500 declined 0.77% and ended at 5,199.50, while the Nasdaq Composite dropped 1.05% to close at 16,195.81. At session highs, the Dow surged 480.30 points, while the S&P 500 jumped 1.73%.

Why is the Dow down 300 points today? ›

U.S. stocks dropped Friday after a softer-than-expected jobs report raised worries about economic growth, which followed Fed signals Wednesday that it could cut interest rates at its September meeting.

What is the return on the US stock market history? ›

The S&P 500 has gained about 10.7% annually since its introduction in 1957. The S&P 500's annual average return in 2023 was 24%, a significant increase from 2022. Returns may fluctuate widely yearly, but holding onto investments over time can help.

Does the stock market do better with a democratic president? ›

The difference in returns between the parties is pretty stark. The average annual return for the S&P 500 index when we had a Republican President was 9.32%. When we had a Democratic President, the S&P 500 average 14.78% per year.

What did the president do about the stock market crash? ›

After the stock market crash, President Hoover sought to prevent panic from spreading throughout the economy. In November, he summoned business leaders to the White House and secured promises from them to maintain wages.

Is it wise to invest in US stocks now? ›

If you're looking to invest for your future -- five, 10, or 40 years from now -- now is as good a time as ever to buy stocks. Despite ongoing recession fears, it's important to remember the market is forward-looking. Stock values are based on future expected earnings.

Why did the Dow drop 1000 points today? ›

Dow plunges more than 1,000 points amid fears of U.S. economic slowdown. Stocks in the U.S. plunged for a third consecutive trading day, with the Dow Jones Industrial Average tumbling more than 1,000 points amid growing fears of an economic downturn sparked by a slowdown in hiring and consumer spending.

Which US stock will go up today? ›

Day Gainers

| Symbol | Name | Price (Intraday) |

|---|

| EDU | New Oriental Education & Technology Group Inc. | 65.27 |

| SHC | Sotera Health Company | 14.22 |

| CABO | Cable One, Inc. | 418.85 |

| ELF | e.l.f. Beauty, Inc. | 175.65 |

21 more rowsSome sources (including the file Highlights/Lowlights of The Dow on the Dow Jones website) show a loss of −24.39% (from 71.42 to 54.00) on December 12, 1914, placing that day atop the list of largest percentage losses.

A stock market collapse typically occurs when the economy is overheated, inflation is rising, market speculation is rampant, and there is significant uncertainty about the path of an economy.

Why is the US market falling? ›

Doubts about US economy

The market rout began on Friday after weaker-than-expected jobs data from the US fuelled speculation that its economy is slowing. In July, US employers added 114,000 roles, far fewer than expected while the unemployment rate ticked up from 4.1% to 4.3%.

How much money do I need to invest to make $3,000 a month? ›

Imagine you wish to amass $3000 monthly from your investments, amounting to $36,000 annually. If you park your funds in a savings account offering a 2% annual interest rate, you'd need to inject roughly $1.8 million into the account.

What is the safest investment with the highest return? ›

Here are the best low-risk investments in July 2024:

- High-yield savings accounts.

- Money market funds.

- Short-term certificates of deposit.

- Series I savings bonds.

- Treasury bills, notes, bonds and TIPS.

- Corporate bonds.

- Dividend-paying stocks.

- Preferred stocks.

And if you had invested $1,000 in Netflix a decade ago, it would have ballooned by more than 654% to $7,543 as of Oct. 17, according to CNBC's calculations.

Is Biden or Trump better for the stock market? ›

Of the 400 investors, traders and money managers polled, 67% said Trump would be better for stocks than President Joe Biden. The S&P 500 rose 68% during Trump's four years in office versus the 44% gain so far under Biden's administration.

What has Biden accomplished? ›

Top Accomplishments

- Lowering Costs of Families' Everyday Expenses.

- More People Are Working Than At Any Point in American History.

- Making More in America.

- Rescued the Economy and Changed the Course of the Pandemic.

- Rebuilding our Infrastructure.

- Historic Expansion of Benefits and Services for Toxic Exposed Veterans.

Moreover, as any other major crisis, the COVID‐19 pandemic was associated with an adverse impact on the financial markets, caused by panic, uncertainty, negative sentiment and investor pessimism during the pandemic.

What is Jill Biden's net worth? ›

Jill Biden's net worth is about $9 million according to Celebrity Net Worth. Her net worth compared to her husband Joe Biden is about the same at $10 million, according to Forbes. The finance news site also reported that First Lady Jill Biden receives a $250,000 pension and an annuity in addition to some cash.