Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, eXp World Holdings, Inc. (NASDAQ:EXPI) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for eXp World Holdings

What Is eXp World Holdings's Net Debt?

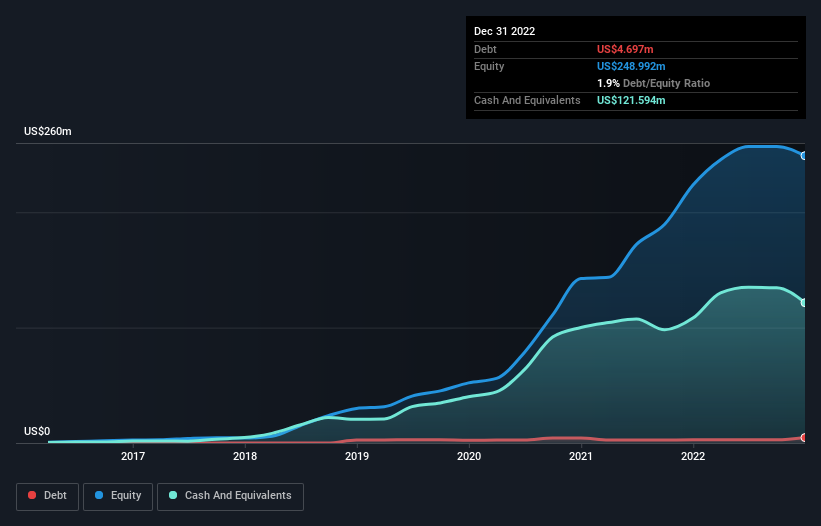

You can click the graphic below for the historical numbers, but it shows that as of December 2022 eXp World Holdings had US$4.70m of debt, an increase on US$2.71m, over one year. But it also has US$121.6m in cash to offset that, meaning it has US$116.9m net cash.

How Strong Is eXp World Holdings' Balance Sheet?

We can see from the most recent balance sheet that eXp World Holdings had liabilities of US$127.3m falling due within a year, and liabilities of US$5.39m due beyond that. On the other hand, it had cash of US$121.6m and US$87.3m worth of receivables due within a year. So it can boast US$76.2m more liquid assets than total liabilities.

This short term liquidity is a sign that eXp World Holdings could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, eXp World Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

In fact eXp World Holdings's saving grace is its low debt levels, because its EBIT has tanked 84% in the last twelve months. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if eXp World Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. eXp World Holdings may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, eXp World Holdings actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that eXp World Holdings has net cash of US$116.9m, as well as more liquid assets than liabilities. And it impressed us with free cash flow of US$198m, being 766% of its EBIT. So we don't have any problem with eXp World Holdings's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for eXp World Holdings that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're helping make it simple.

Find out whether eXp World Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

As an expert in financial analysis and investment strategies, my extensive knowledge in the field enables me to dissect complex financial articles with precision and clarity. The excerpt you provided delves into the financial health of eXp World Holdings, Inc. (NASDAQ:EXPI), focusing on the company's use of debt and its overall risk profile. I'll provide a detailed breakdown of the concepts discussed in the article to shed light on the key financial indicators and their implications.

1. Li Lu's Investment Philosophy: Legendary fund manager Li Lu's quote emphasizes the importance of avoiding a permanent loss of capital rather than being overly concerned with short-term price volatility. This philosophy underscores the significance of assessing a company's financial health, particularly its use of debt, to gauge the risk of permanent capital impairment.

2. Debt and Risk: The article highlights the potential risks associated with a company's use of debt. Excessive debt, if mismanaged, can lead to financial ruin, as businesses may struggle to meet their debt obligations, resulting in dilution of shareholder value or, in extreme cases, bankruptcy.

3. eXp World Holdings' Debt Profile: The analysis of eXp World Holdings' financials reveals that as of December 2022, the company had $4.70 million in debt, an increase from $2.71 million over the past year. However, the crucial factor is that the company also holds $121.6 million in cash, resulting in a net cash position of $116.9 million.

4. Balance Sheet Strength: The balance sheet is examined to assess the company's overall financial strength. eXp World Holdings is reported to have $76.2 million more in liquid assets than its total liabilities, indicating short-term liquidity that could facilitate the payment of its debt obligations.

5. EBIT and Profitability: Despite a notable 84% decline in EBIT (Earnings Before Interest and Taxes) over the last twelve months, eXp World Holdings is viewed favorably due to its low debt levels. The article suggests that the company's ability to manage debt is not solely determined by current earnings but also by its potential for future profitability.

6. Free Cash Flow and Debt Management: The article emphasizes the importance of a company's ability to convert EBIT into free cash flow. In this regard, eXp World Holdings is noted for producing more free cash flow than EBIT over the last three years, indicating a positive sign for managing debt obligations effectively.

7. Investor Considerations: The conclusion drawn is that, despite the concerns about debt, eXp World Holdings' net cash position, substantial liquid assets, and impressive free cash flow mitigate the perceived risks. The article advises investors to focus on the balance sheet while acknowledging that risks may exist beyond the financial statements.

In summary, the analysis provides a comprehensive overview of eXp World Holdings' financial position, delving into key metrics such as debt, balance sheet strength, EBIT, and free cash flow. This holistic approach is essential for investors seeking a nuanced understanding of the company's risk profile and financial viability.