editorial-team@simplywallst.com (Simply Wall St)

·4 min read

The Indian stock market has experienced a period of relative calm with flat performance over the past week, yet it has shown robust growth with a 43% rise in the past 12 months, alongside an optimistic forecast of 18% annual earnings growth. In this context, dividend stocks emerge as compelling options for investors seeking steady income streams and potential long-term value in a market ripe with growth opportunities.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

EPL (BSE:500135) | 2.20% | ★★★★★★ |

Narmada Gelatines (BSE:526739) | 2.44% | ★★★★★★ |

Vinyl Chemicals (India) (BSE:524129) | 2.52% | ★★★★★★ |

Swaraj Engines (NSEI:SWARAJENG) | 3.85% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.10% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.53% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 2.65% | ★★★★★☆ |

Sun TV Network (NSEI:SUNTV) | 2.42% | ★★★★★☆ |

Ruchira Papers (NSEI:RUCHIRA) | 3.77% | ★★★★★☆ |

Bank of Baroda (NSEI:BANKBARODA) | 2.03% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

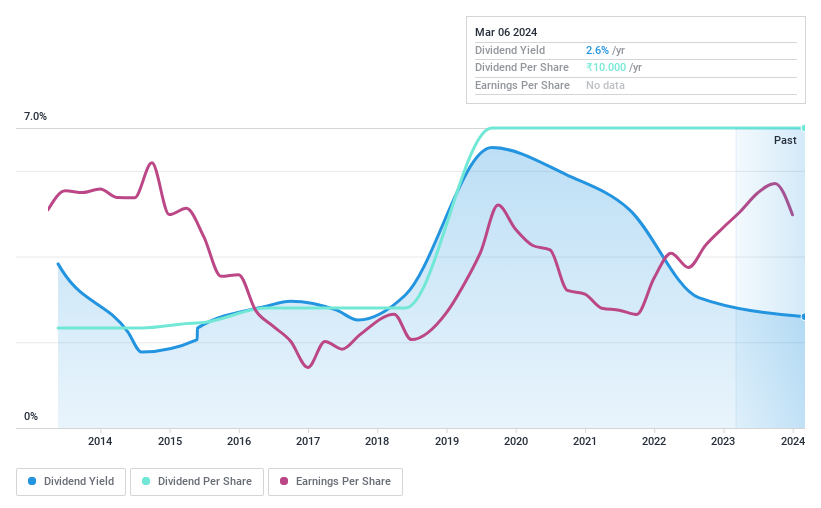

Narmada Gelatines (BSE:526739)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Narmada Gelatines Limited is a company engaged in the production and sale of gelatine and its by-products, serving both domestic and international markets, with a market capitalization of approximately ₹2.48 billion.

Operations: Narmada Gelatines Limited's operations focus on the manufacture and commercialization of gelatine and its derivatives, catering to a diverse client base across global markets.

Dividend Yield: 2.4%

Narmada Gelatines (BSE:526739) emerges as a debt-free entity, enhancing its appeal to dividend-seeking investors. Over the past five years, the company has seen a steady earnings growth of 7.3% per year, with recent profit margins improving to 8.3%. Although last year's earnings growth decelerated slightly below the five-year average, Narmada Gelatines maintains a sustainable dividend policy with low payout ratios—46.8% from earnings and 35.8% from cash flow—indicating dividends are well-covered. The firm has also demonstrated reliability and stability in its dividend payments over the past decade, positioning its yield attractively within the top quartile of Indian market payers at 2.44%.

Discovering a possibly undervalued opportunity can be exciting, but ensuring it fits well within your investment goals is essential. Do so seamlessly using the analytical power of Simply Wall St's portfolio tool.

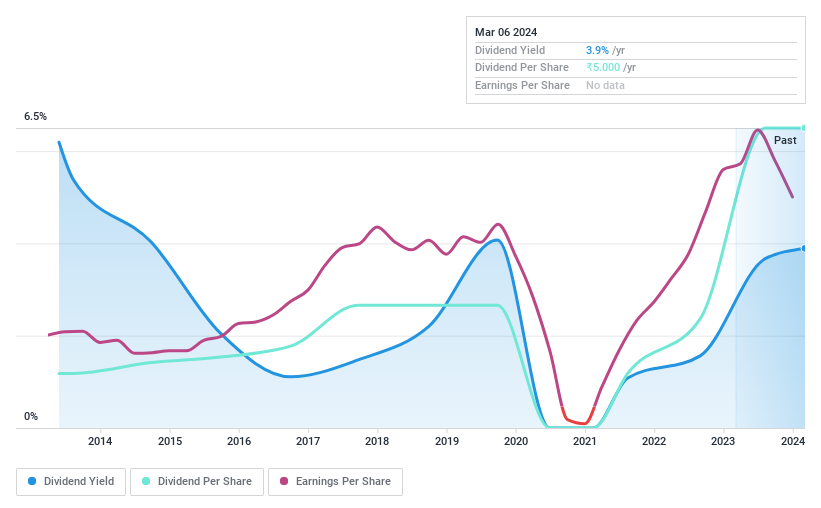

Ruchira Papers (NSEI:RUCHIRA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ruchira Papers Limited is an India-based company engaged in the manufacturing and international sale of paper and paper products, with a market capitalization of approximately ₹3.95 billion.

Operations: Ruchira Papers Limited generates its revenue primarily through the manufacturing of paper, with a reported segment revenue of ₹6.78 billion.

Dividend Yield: 3.8%

Ruchira Papers stands out for its robust reduction in debt, slashing its debt to equity ratio from 29.9% to a mere 7% over five years, reflecting a strengthened balance sheet. The company's earnings have surged by an annual average of 21.5% during the same period, although it faced a setback with negative earnings growth over the last year. Its dividends appear sustainable with low payout ratios and are supported by both earnings and operating cash flow, ensuring shareholder returns are well-protected. However, investors should note the volatility in dividend payments over the past decade despite recent increases—a factor that may weigh on its attractiveness as a consistent income stock amidst India's top dividend payers.

Take a closer look at Ruchira Papers' potential here in our dividend report.

Our valuation report here indicates Ruchira Papers may be overvalued.

You might want to monitor its performance and wait for a better entry point by using Simply Wall St's watchlist.

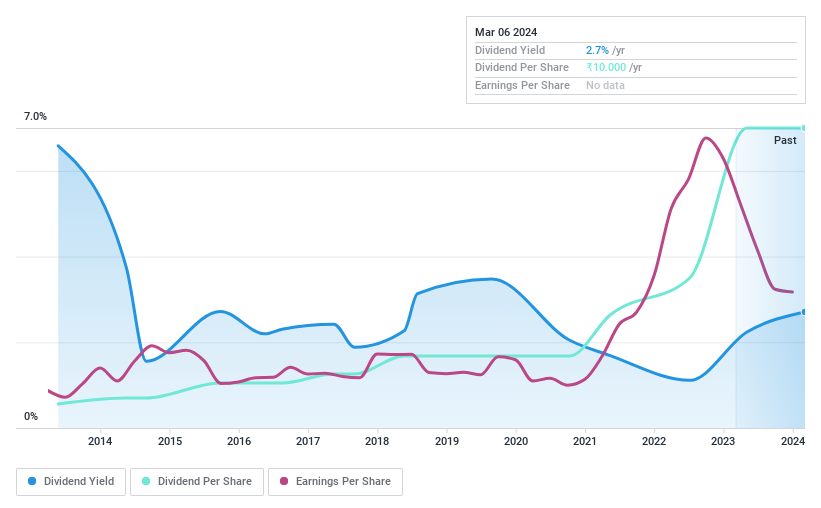

Vinyl Chemicals (India) (BSE:524129)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Vinyl Chemicals (India) Limited is a company engaged in the trading of a diverse range of chemicals within the Indian market, with a market capitalization of approximately ₹7.29 billion.

Operations: Vinyl Chemicals (India) Limited generates its revenue primarily through the trading of chemicals, with a reported segment revenue of ₹5.36 billion.

Dividend Yield: 2.5%

Vinyl Chemicals (India) presents a nuanced case for dividend investors, with its debt profile improving as evidenced by a halved debt to equity ratio over five years and cash reserves exceeding total debt. The company's earnings have seen robust growth historically, though recent negative earnings growth contrasts this trend. Dividend sustainability is a bright spot, with low payout ratios from both earnings and cash flow underpinning consistent payouts that have grown over the past decade. Yet, investors should be mindful of the current lower net profit margins compared to last year and lack of data on expected future profit and revenue growth—factors that introduce an element of caution in assessing Vinyl Chemicals' long-term dividend prospects amidst India's diverse market offerings.

Dive into the specifics of Vinyl Chemicals (India) here with our thorough dividend report.

You can save this company for future evaluation in a Simply Wall St watchlist should market dynamics shift favorably.

Where To Now?

Harness the power of insightful data analysis to explore top-performing dividend stocks in India using the Simply Wall St screener. Delve into our full catalog of 55 Top Dividend Stocks here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com